Table of Contents

- Introduction: Google Expands Scam Protection

- How Google In-Call Scam Protection Android Works

- Pilot Programs and Global Expansion

- Benefits for Users and Banks

- Conclusion: Strengthening Android Financial Security

- Related Reads

Introduction: Google Expands Scam Protection

Google has recently announced the expansion of its In-Call Scam Protection on Android, aiming to protect users from financial fraud and impersonation scams while using banking and fintech apps. Initially piloted in the UK, the feature is now available in the US, Brazil, and India, covering most major banks and fintech applications. The feature represents Google’s commitment to enhancing digital safety, particularly as scammers increasingly exploit screen sharing and real-time calls to steal sensitive financial information.

Financial fraud has become more sophisticated, with fraudsters tricking users into sharing screens, revealing account details, or authorising transactions unknowingly. Google’s new system leverages AI and real-time alerts to detect suspicious call activity during banking app usage. The company has partnered with institutions like JPMorgan Chase and fintech apps like Cash App to deliver this protective feature.

How Google In-Call Scam Protection Android Works

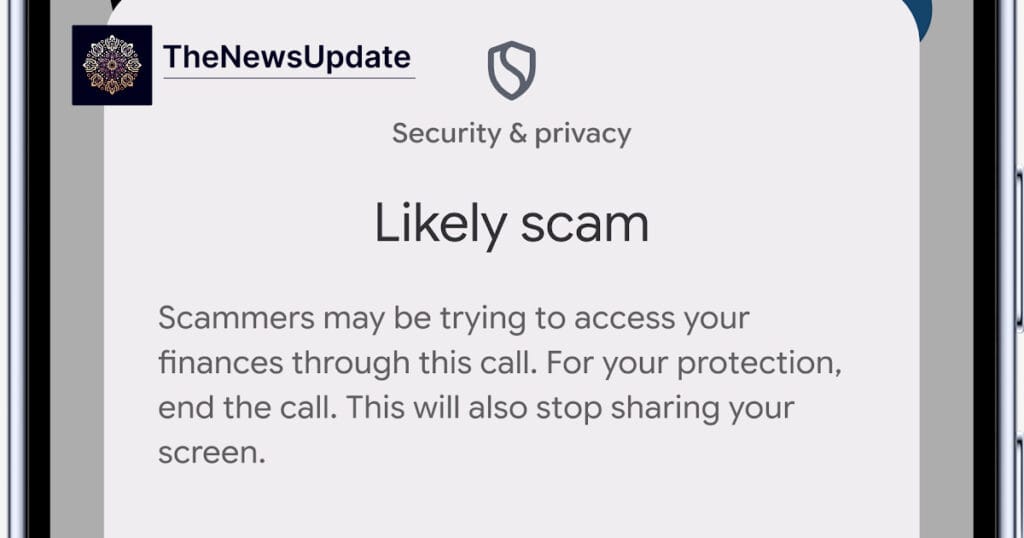

The Google In-Call Scam Protection Android feature is designed to prevent scam attempts when users are sharing their phone screens during calls while using a banking app. Here’s how it works:

- When a user opens a supported financial app and starts screen sharing while on a call with an unknown number, the system detects potential risk.

- Android phones display an instant warning alert about the potential scam.

- The system provides options to immediately end the call or stop screen sharing with a single tap.

- Alerts include a 30-second pause before proceeding, giving users time to reconsider any suspicious activity prompted by scammers.

This approach combines proactive warning systems with user control. Instead of simply detecting scams, it educates users to be cautious and provides actionable steps to prevent fraud.

By integrating scam protection directly into Android, Google ensures that users do not need additional apps or manual intervention to stay safe. This native protection also leverages device-level permissions and AI to identify patterns typical of financial scams.

Pilot Programs and Global Expansion

Before rolling out in the US, Google tested the in-call scam protection feature in the UK earlier this year. The pilot successfully helped thousands of users avoid potential scams by prompting them to end suspicious calls before sensitive financial information was compromised.

Following positive results, Google expanded the pilot to Brazil and India. Indian users can now receive alerts when using participating banking apps like HDFC Bank, ICICI, or fintech platforms that have integrated the feature. Google continues to partner with banks to widen coverage and enhance the protection ecosystem.

The global expansion reflects Google’s understanding that scam tactics are universal, and effective countermeasures require real-time, device-level intervention. By piloting in diverse markets, Google can fine-tune detection algorithms to account for regional scam trends and banking behaviours.

Benefits for Users and Banks

The Google In-Call Scam Protection Android feature provides multiple benefits to both users and financial institutions:

- Enhanced User Safety: Real-time warnings prevent fraud and financial loss during sensitive activities.

- Reduced Impersonation Risk: Scammers posing as bank officials are less likely to succeed in obtaining screen access.

- Minimal Friction: Users can continue transactions safely with one-tap actions to end calls or stop sharing.

- Trust for Banks: Partner banks benefit from lower fraud cases and increased customer confidence.

- Scalable Protection: AI-powered detection adapts to new scam methods without constant manual updates.

By prioritising user safety, Google reinforces Android as a secure platform for banking and fintech operations. With the rise of digital payments, protecting screen sharing and sensitive information is critical to maintaining consumer trust.

Conclusion: Strengthening Android Financial Security

Google’s expansion of In-Call Scam Protection Android highlights the tech giant’s proactive approach to combating financial fraud. By combining AI detection, real-time alerts, and global partnerships, the feature empowers users to act decisively against scams and reduces the likelihood of financial loss.

As scammers continue to develop more sophisticated techniques, features like Google’s in-call protection demonstrate how mobile operating systems can take a central role in cybersecurity for banking apps. Users in the US, UK, Brazil, and India can now benefit from this layer of protection, and further expansion is expected in other global markets.

Overall, Google’s initiative represents a significant step in making Android devices safer for financial transactions, helping users navigate the digital banking world with confidence.

Related Reads

By The Morning News Informer — Updated 4 December 2025